(Bloomberg) -- Funds and asset managers boosted bullish bets on the Mexican peso to the highest level in at least a year as the currency continues to defy calls it’s overvalued.

Derivatives data from the Commodity Futures Trading Commission show leveraged funds holdings rose to 45,186 contracts, while institutional asset managers increased their positioning to 173,897 contracts, the equivalent of $5.2 billion in bullish peso trades. Those were the largest holdings since last March and December 2022, respectively.

The data covers the week through March 19, when the Bank of Japan put an end to the era of negative interest rates. The dovish tilt helped the peso breach 17.00 per dollar, gaining momentum on back of an improved outlook for carry trade currencies. The use of the Japanese yen as a funding currency has been popular with carry traders — who borrow in lower-yielding currencies to buy those that offer higher yields — in Latin America for nearly a decade.

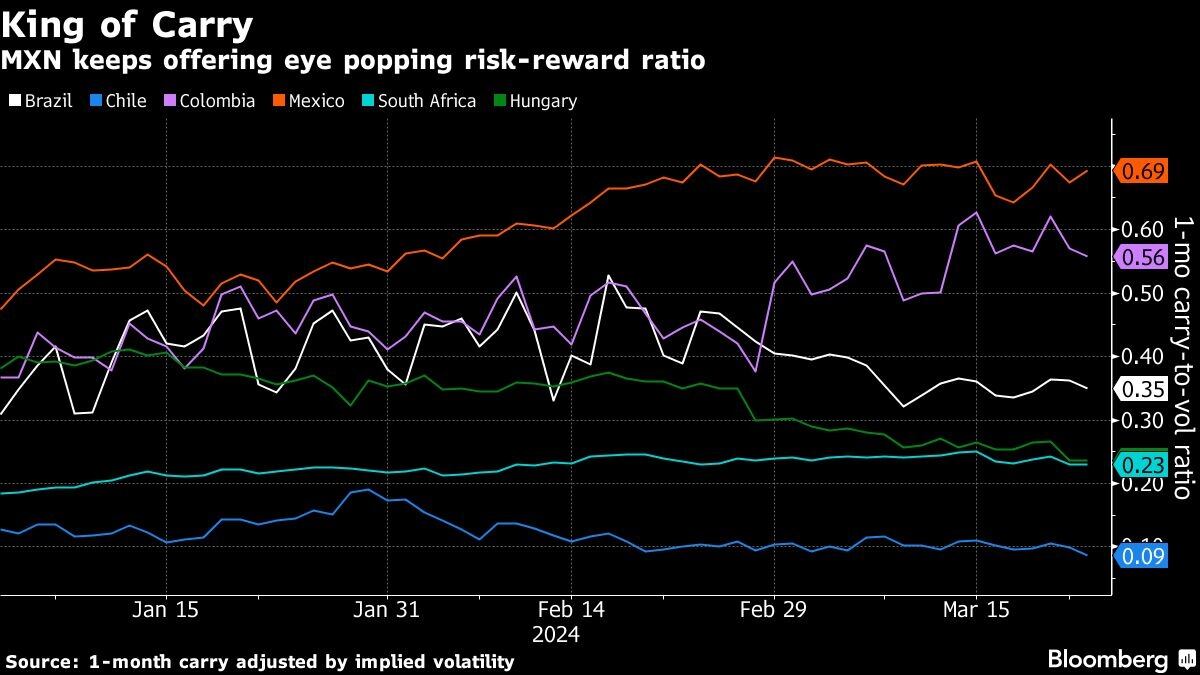

Even after rallying the most in a quarter century in 2023, Mexico’s peso is the best-performing currency in the world this year as high rates globally and low volatility make it attractive. The currency’s risk-reward ratio is almost double that of some peers, data compiled by Bloomberg show.

Not even the beginning of the easing cycle in Mexico last week is set to change trader’s bullish views as Banxico left the door open for holding its key rate in some of the upcoming meetings. Traders are pricing in only 55 basis points of cuts over the next six months, which would make the cycle far less aggressive than that seen for peers, further improving the peso’s outlook.

©2024 Bloomberg L.P.