(Bloomberg) -- The European Central Bank’s direction toward further easing policy is “clear” as it’s on course to bring inflation to its 2% target sustainably by the summer and economic growth has disappointed, Governing Council member Francois Villeroy de Galhau said.

The Bank of France governor spoke the day after the ECB lowered its deposit rate by a quarter-point for a fourth straight meeting as it considered the continent’s disinflation process is “well on track.”

Data on Thursday also showed an economic stagnation in the euro area in the fourth quarter, contributing to the ECB’s assessment that risks to activity are tilted to the downside.

“With such a ‘disinflationary slowdown,’ the direction of the travel is clear: our monetary policy will go from restrictive toward neutral, and should support a gradual recovery while ensuring inflation is at our target,” Villeroy said. “How fast and how far should we go in this travel? This is where what I call “agile pragmatism” and our data driven approach will guide us.”

Speaking at an OMFIF conference in London, he also highlighted that “long term yields have increased, limiting the easing of overall financial conditions.”

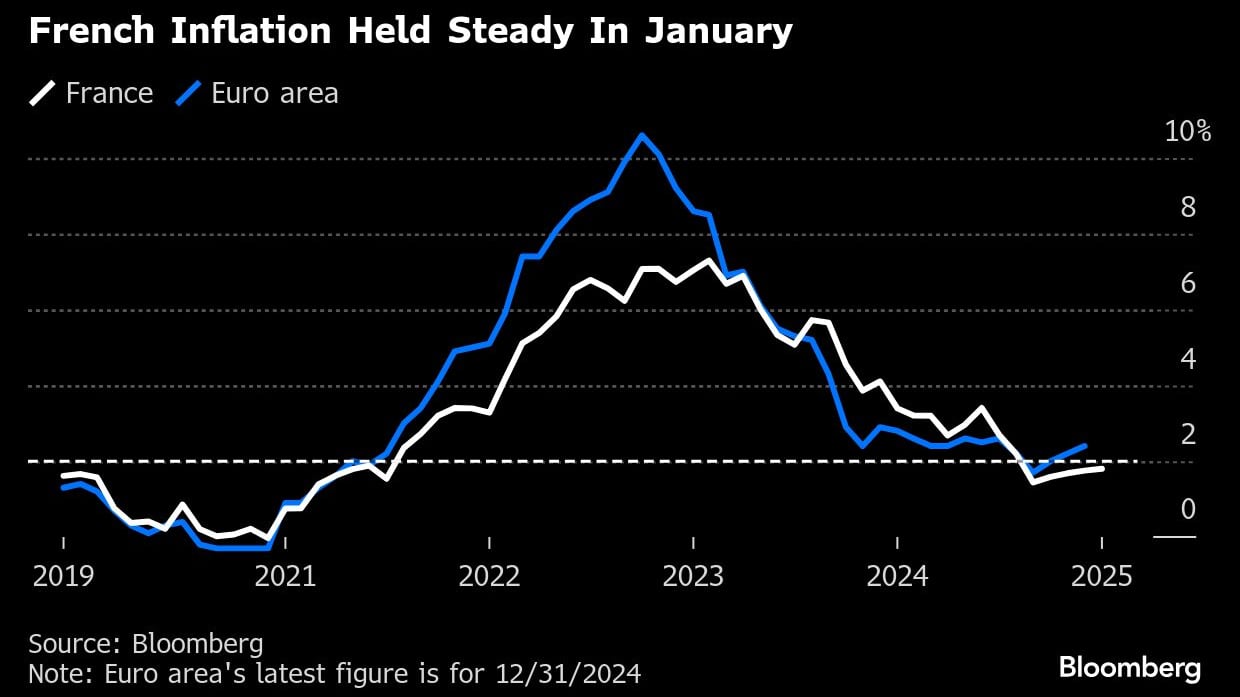

Data for France earlier Friday showed inflation there remained below the ECB’s 2% target for the fifth month in January. In services, which is closely watched as a gauge of momentum in prices, the rate fell below 2% for the first time in more than three years.

The data pushed traders to increase bets on further easing from the ECB. Villeroy has previously said that the central bank could keep cutting in the first four meetings of 2025 to bring the deposit rate to 2% by the summer from 2.75% currently.

“We see significant wage deceleration and are hence confident on core inflation decrease, including services,” Villeroy said.

The French central bank chief also said:

- “Victory over inflation is now in sight.”

- “To put it in a nutshell: as the ECB president said, we are precisely on track in our victorious fight against inflation.”

- “Looking ahead, we should be sustainably around our 2% inflation target by this summer.”

- “On activity, we avoided recession last year with 0.7% growth, and will again avoid it this year. But the somewhat disappointing GDP stagnation in Q4 published yesterday confirms that risks on growth are clearly tilted to the downside.”

©2025 Bloomberg L.P.