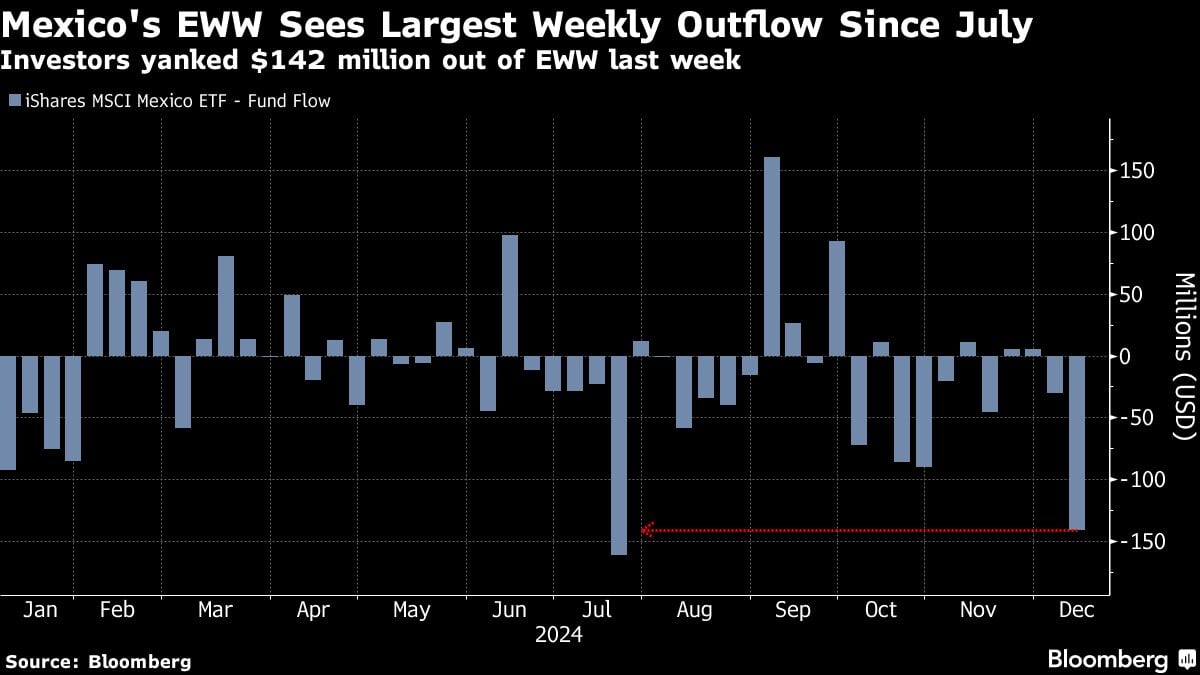

(Bloomberg) -- An exchange-traded fund tracking Mexican stocks posted its biggest outflow of money last week since July, the latest stage in a long-term selloff as threats to trade with its North American neighbor mounted.

The $1.1 billion iShares MSCI Mexico ETF, known by its ticker EWW, recorded $142 million in outflows in the week through Dec. 13. The losses brought the reduction in its total value since April to about $1.1 billion.

The drop started even before the Morena party won a landslide election victory, raising concern that the government would interfere more in the economy and push ahead with other market unfriendly policies. The decline was extended more recently after Donald Trump won the US vote and threatened to impose tariffs on Mexico.

“Mexico has gone from one crisis to the next with Morena’s landslide win, judicial reform, and now coping with the US election result,” said Rodolfo Ramos, a strategist at Bradesco BBI. “Next year might be the year Mexico gets a break, but it will remain volatile as the US pays more attention to bilateral issues on security, immigration, and trade.”

Trump’s win reignited fears that the world’s largest economy would slap tariffs on goods from China, Mexico and Canada. Besides threats on tariffs, Trump has blasted Mexico with claims the government should do more to curb undocumented migration and fentanyl smuggling.

“Mexico’s new year is full of uncertainty,” said Malcolm Dorson, senior portfolio manager at Global X Management. Investors are concerned about “how Mexico can appease the US without risking losing investment from China.”

Economists have revised their 2025 forecasts for Mexico, expecting a fourth straight year of diminishing growth and less foreign investment due to Trump’s threat of 25% tariffs. According to an estimate by Bloomberg Economics, such steep tariffs would risk nearly 11% of Mexico’s gross domestic product.

Still, Latin America’s second-largest economy is unlikely to meet Trump’s demands to stem the flow of migrants and drugs over the border, and instead may focus on doing enough to avoid tariffs.

At the end of November, Mexico’s President Claudia Sheinbaum said she is convinced that her country can reach a deal with the US to avoid the 25% tariff threatened by Trump.

“It’s clear investors are cautious, but until we know what the tariffs will look like its hard to make a solid prediction,” said Greg Lesko, managing director at Deltec Asset Management LLC in New York. “Until the dust settles, I would expect flows to remain muted.”

Investors will also be closely monitoring the nation as it gears up for the review and possible renegotiation of the USMCA, set for the middle of 2026 at the latest.

- Stock ETFs expanded by $432.1 million.

- Bond funds fell by $287.4 million.

- Total assets fell to $363.6 billion from $363.9 billion.

- The MSCI Emerging Markets Index closed up 0.2 percent from the previous week at 1,107.01 points.

- China/Hong Kong had the biggest inflow, of $251.1 million, led by DWS Xtrackers’ Xtrackers Harvest CSI 300 China A-Shares.

- Mexico had the biggest outflow, of $148.8 million, following withdrawals from iShares MSCI Mexico.

Note: Bloomberg updated the screening criteria for its emerging market ETF search in November 2024.

Click here for Bloomberg’s ETF screening applications.

Following are tables detailing net flows for emerging-market ETFs in US dollars. The data include the holdings-weighted allocations from multi-country funds, as well as country-specific funds. Latest and historic flows are allocated using latest fund weightings (figures in USD millions unless otherwise stated):

Regional Summary

Click here for Bloomberg’s ETF Excel library.

Americas

Asia Pacific

Europe, Middle East & Africa

©2024 Bloomberg L.P.