Six takeaways from Ontario's spending watchdog on how the province's cannabis business is doing

Ontario's auditor general published her annual report on Wednesday, devoting one section of their analysis to the efficiencies of the province's spending on its cannabis operations. The audit of the Ontario Cannabis Retail Corporation (OCRC) came with a total of 16 recommendations on how the business should improve its operations going forward. Here's a snapshot of some of the key takeaways contained within that report.

Inventory struggles: The OCRC frequently ran out of products that should have been made available through its wholesale division, which Ontario's brick-and-mortar retailers are supplied with. According to a survey the auditor general conducted in July, two-thirds of respondents said they weren't satisfied with product availability from the OCRC. As well, on any given day, about 19 per cent of all wholesale cannabis products listed by OCRC were not in stock or available for retailers to order. The OCRC also was found to have inaccurate inventory forecasting data, which wound up leading to higher costs and missed sales in the first six months of the year.

Executive calls: Some industry executives were able to reverse decisions made by the Ontario Cannabis Store (OCS) to delist underperforming products by ringing up top OCS staff directly. While the auditor general said that she didn't come across any examples of preferential treatment awarded to licensed producers, these "informal escalations" can create a perceived lack of fairness, and the watchdog recommended the OCS conduct a formal appeal process to mitigate any further issues.

Too many products?: There are nearly 1,800 cannabis products available for sale in the province, an eye-popping figure that highlights how increasingly fragmented the state of the legal marijuana industry in Canada has become. The Ontario auditor general found that there are 1,774 cannabis products available for sale in the province, nearly half of which (793) are dried flower offerings sold by 186 licensed producers. The sheer number of products on the market is a leading reason why so many Canadian cannabis players have struggled to reach profitability.

Pricing decisions: The auditor general found that the way the OCRC priced its recreational cannabis products wasn't made with a formal analysis before it was implemented. The so-called "value-based pricing approach" aimed to price products based on a customers’ perceptions and willingness to pay for a certain product, but was not set out in a way that justified moving to that particular pricing model. That resulted in some confusion from a handful of licensed producers who were found to not have a clear understanding of how product prices are determined, the report said.

Poor customer service: The OCRC opted to bring in-house its customer care staffing from a third-party earlier this year, but that move resulted in longer wait times for inquiries, claims, and complaints, the auditor general found. While getting rid of outsourcing would save the OCRC about $550,000, it saw significant delays in resolving customer claims and complaints. That has led to a majority of retailers polled by the auditor general to describe themselves as dissatisfied with the OCRC's ability to deal with customer complaints.

Weak data management: The auditor general found that the OCRC doesn't have an effective way to oversee the customer data that it - and its third-party logistics provider Domain Logistics that manages its warehousing - collects from every sale. While the OCRC developed a data strategy in May, at the time of the auditor general's audit, it lacked a governance component, that includes what data it has, where it resides, how it's used and what compliance it needs to adhere to. While the data itself may not be entirely germane to its business, journalist Patrick Cain tweets that Canadians have no Fourth Amendment protections over their data stored on servers in the U.S., which is where Domain Logistics is based and could have further implications for Ontario pot consumers given the current U.S. federal laws on cannabis.

TOP NEWS OF THE WEEK

Constellation CEO steps down from Canopy's board, replaced by CFO

Constellation Brands CEO Bill Newlands stepped down from Canopy Growth's board last month, according to a regulatory filing published on Nov. 29. Newlands, whose Constellation Brands owns a 36.1 per cent stake in Canopy, will be replaced by Garth Hankinson, the U.S. beer distributor's chief financial officer. As part of Constellation's investment in Canopy, the company is entitled to control four of Canopy's board seats. No reason was provided for Newlands' departure from Canopy's board although he told investors during a recent conference hosted by Morgan Stanley that Constellation views cannabis as an "important business" in the future. "Certainly, it's taken longer than we had initially anticipated, but we still are optimistic that it's going to be a big business over the course of time," Newlands said. He added that there's no plan to exercise the warrants Constellation holds in Canopy, which would give the company majority control over the pot giant.

New Brunswick introduces bill to further privatize cannabis retail

More cannabis stores are coming to New Brunswick after the province's finance minister introduced legislation that would spur the development of more privately-owned outlets. Ernie Steeves put forth the bill, that would allow the provincially-owned Cannabis N.B. to expand its business model through private retail stores and direct-from-producer farmgate operations, the CBC reports. The move should help bolster the province's legal cannabis market against illicit players, Steeves said. While the legislation has yet to be passed into law, smaller outlets should help boost the province's cannabis operations, which recently turned a profit earlier this year.

Malawi treads cautiously on anointing Mike Tyson as cannabis ambassador

Malawi might be getting cold feet after announcing former heavyweight champion boxer Mike Tyson will become the country's official cannabis ambassador, CNN reports. The African nation, which has legalized the growing and processing of cannabis for medicinal purposes, invited Tyson to be the face of its marijuana industry in a move it believes will help draw attention from investors and tourists. However, Malawian think tank, the Centre for Public Accountability, blasted the decision, given that Tyson was convicted of rape in 1992. CNN reports that the head of the think tank calls Tyson's appointment "wrong" and that being the face of the country's cannabis industry is "something beyond reformatory", while recommending replacing him with someone less controversial in that role. Further complicating the issue is that, according to Tyson's representatives, they haven't received any invitation from the Malawian government to take part in the country's cannabis industry.

The one where the Friends producer lobbies New York State on cannabis

New York’s cannabis industry is poised to get a little bit more Hollywood as the executive producer of Friends looks to establish a marijuana cultivation farm in the state, according to Cannabis Wire. Kevin Bright, who was one of the executive producers for Friends, is lobbying the New York State government through a firm to turn his 400 acres of farmland into a cannabis agritourism business. Bright and his wife aren't in the cannabis industry for the money - they're also among the founding donors of the UCLA Cannabis Research Initiative, according to Cannabis Wire. In addition to the farm plans, the Brights are lobbying the government to help support further banking and funding opportunities for the industry.

Quarterly Results Wrap:

Flowr, Harborside and Red White & Bloom

Here's a summary of some of the cannabis industry companies that reported quarterly results this week:

- Flowr Corp: Third quarter revenue down 10.7 per cent to $2.5 million, $9.1 million in a net loss, compared to a $10.1 million loss a year earlier. (Release)

- Gage Growth: Third quarter revenue up 119.6 per cent to US$27.2 million, US$1.8 million in an adjusted EBITDA loss, compared to a US$2.0 million loss a year earlier. (Release)

- Flower One: Third quarter revenue up 18 per cent to US$14.1 million, US$10.1 million in adjusted EBITDA, compared to a US$10.7 million loss a year earlier. (Release)

- Harborside: Third quarter revenue up 14.3 per cent to US$17.5 million, US$1.4 million in adjusted EBITDA, compared to a US$4.3 million gain a year earlier. (Release)

- Red White & Bloom: Third quarter revenue up 93 per cent to US$11.8 million, US$5.9 million in adjusted EBITDA, compared to a US$5.8 million loss a year earlier. (Release)

- Cansortium: Third quarter revenue up nine per cent to US$15.6 million, US$4.9 million in adjusted EBITDA, compared to a US$3.6 million gain a year earlier. (Release)

ANALYST NOTE OF THE WEEK

BMO Capital Markets on upcoming sales figures

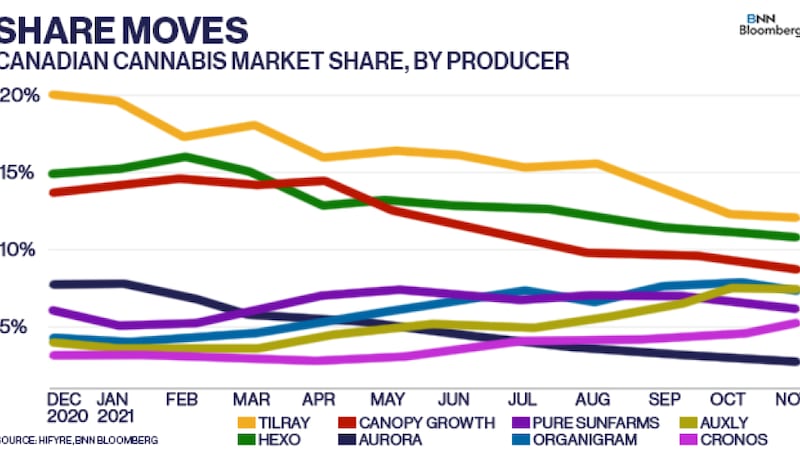

BMO Capital Markets Analyst Tamy Chen said that cannabis industry data tracker Hifyre is projecting sales in November will come to $329 million, something that she views as "surprising," given that the fourth-quarter period is typically one that gets a holiday-spending boost. BMO estimates the monthly figure will be closer to $333 million, which represents a five per cent decline from October's sales data. Chen hypothesizes that the decline could be coming from the oversaturation of retail outlets in Ontario, which could impact the amount of sales momentum in the province.

Meanwhile, Chen notes that the supply of high THC dried flower products - where potency is now viewed to be a minimum of 22 per cent THC - has been steadily increasing over the past few months, driven by craft producers. Bigger licensed producers, already on the backfoot with market share declines, could see a rebound if they begin to shift their cultivation to more indoor facilities and invest in new unique genetics, while charging a lower price point than smaller craft players. "There is constant pressure on LPs to introduce new strains, which come with production disruptions and higher costs during the initial period of growing new genetics at scale," Chen said.

Of the bigger cannabis producers, most of them lost market share in November, led by Canopy Growth and Village Farms International's Pure Sunfarms. Only Auxly Cannabis showed a gain in share during the quarter, and it now represents the third-biggest cannabis producer in the country with nearly 11 per cent of the market. "The recent appearance of Auxly, Cronos, and Valens flower products in high rankings in the Top 100 Products list supports the notion that cannabis consumers respond well to newness, whether that is new genetics and/or newer entrants," Chen said.

CANNABIS SPOT PRICE:

$5.01 per gram

-- This week's price is up 0.9 per cent from the prior week, according to the Cannabis Benchmark’s Canada Cannabis Spot Index. This equates to US$1,780 per pound at current exchange rates.

WEEKLY BUZZ:

3,800

- The number of scientific papers on the subject of cannabis published so far in 2021, the largest amount of research material published in a single year, according to Norml.