(Bloomberg) -- Taiwan Semiconductor Manufacturing Co. scaled back its outlook for a chip market expansion, cautioning that the smartphone and personal-computing markets remain weak.

The world’s largest maker of advanced chips cut its expectations for 2024 semiconductor market growth — excluding memory chips — to about 10%, from above that figure. Chief Executive Officer C. C. Wei also trimmed his growth forecast for the foundry sector, which TSMC leads. Meanwhile, the company maintained its estimates for spending at anywhere between $28 billion and $32 billion amid capacity expansion and upgrades this year.

“Macroeconomic and geopolitical uncertainty persists, potentially weighing on consumer sentiment and end-market demand,” Wei told analysts on a conference call. TSMC’s stock slid more than 6% in Taipei, the biggest intraday decline in about 18 months.

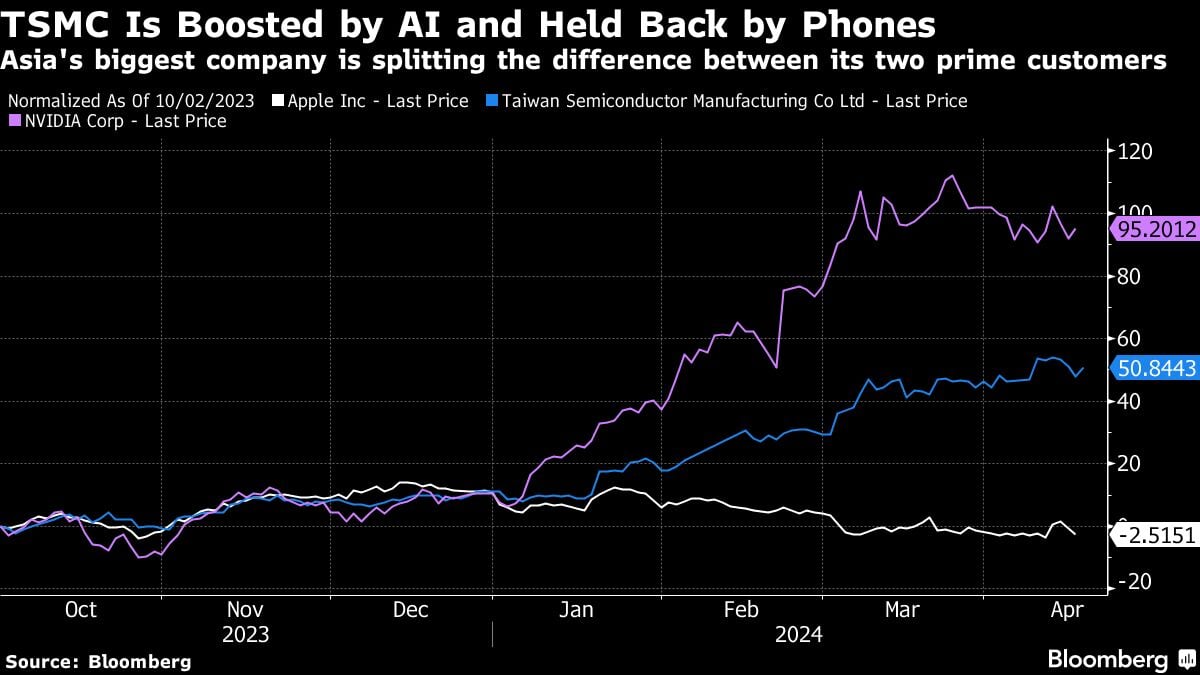

The outlook overshadowed what was otherwise a solid beat on projected revenue that reaffirmed the growth TSMC and other chipmakers are seeing from demand for all things artificial intelligence. The new forecast also highlights the diverging fortunes of those who make chips for consumer products and those who are designing and manufacturing the most advanced chips for AI processing.

TSMC’s forecasts may prove to be a sign of what’s to come as other chip giants prepare to post earnings. ASML Holding NV — the sole provider of the world’s most advanced chipmaking machines — reported a 22% miss on first-quarter bookings on Wednesday. Other companies including Intel Corp. report next week.

Inside TSMC Chairman Liu’s Short But Impactful Reign: Tim Culpan

For a liveblog on TSMC’s earnings, click here.

TSMC’s forecast follows the company’s first quarterly profit rise in a year. The main chipmaker to Nvidia Corp. and Apple Inc. expects revenue of $19.6 billion to $20.4 billion in the June quarter, beating estimates for about $19.1 billion.

That outlook may help assuage some investors worried that AI demand won’t hold up, or that a smartphone recovery may be longer in coming. TSMC only last week disclosed its fastest sales growth since 2022, suggesting demand for the chips that accelerate artificial intelligence development is beginning to offset the fallout from a smartphone market slump. Apple, which accounted for about a quarter of TSMC’s revenue in 2023, started the year with a deep decline in iPhone sales.

TSMC continues to expect revenue to grow by at least 20% this year as the broader semiconductor market recovers, despite global macroeconomic volatility.

The Taiwanese chipmaker said it will begin mass production of next-generation 2nm chips in the last quarter of 2025, narrowing its timeframe from next year in general. And Wei added that TSMC’s automotive business will fall this year, versus previous projections for a rise, without elaborating.

TSMC has gained about $340 billion of market value since an October 2022 trough, riding bets it will become one of the clearest winners of a global boom in AI development. On Thursday, it recorded a better-than-projected 9% rise in net income to NT$225.5 billion ($7 billion) for the March quarter.

Executives said the earthquake that rocked Taiwan this month damaged some wafers used in its chip production, depressing gross margins by about 50 basis points or 0.5 percentage point in the June quarter.

Read More: TSMC Says Quake Damaged Some Wafers, Leading to Small Profit Hit

Longer term, investors expect AI-focused chips to gradually take up a larger proportion of revenue. TSMC’s AI revenue is growing at a rate of 50% annually, the company said in January.

Still, some investors have warned that the current level of AI chip demand is unsustainable over the long run. Others remain wary given the uncertainty hanging over the Taiwan Strait — the narrow body of water between China and an island it views as part of its territory.

“The demand is very high, extremely high, and we’ll do our best to increase our capacity to alleviate the shortage,” Wei said of AI demand. “Probably not enough this year, but for next year we’ll try very hard.”

--With assistance from Gao Yuan, Mayumi Negishi, Ville Heiskanen and Cindy Wang.

(Adds share action in the third paragraph)

©2024 Bloomberg L.P.