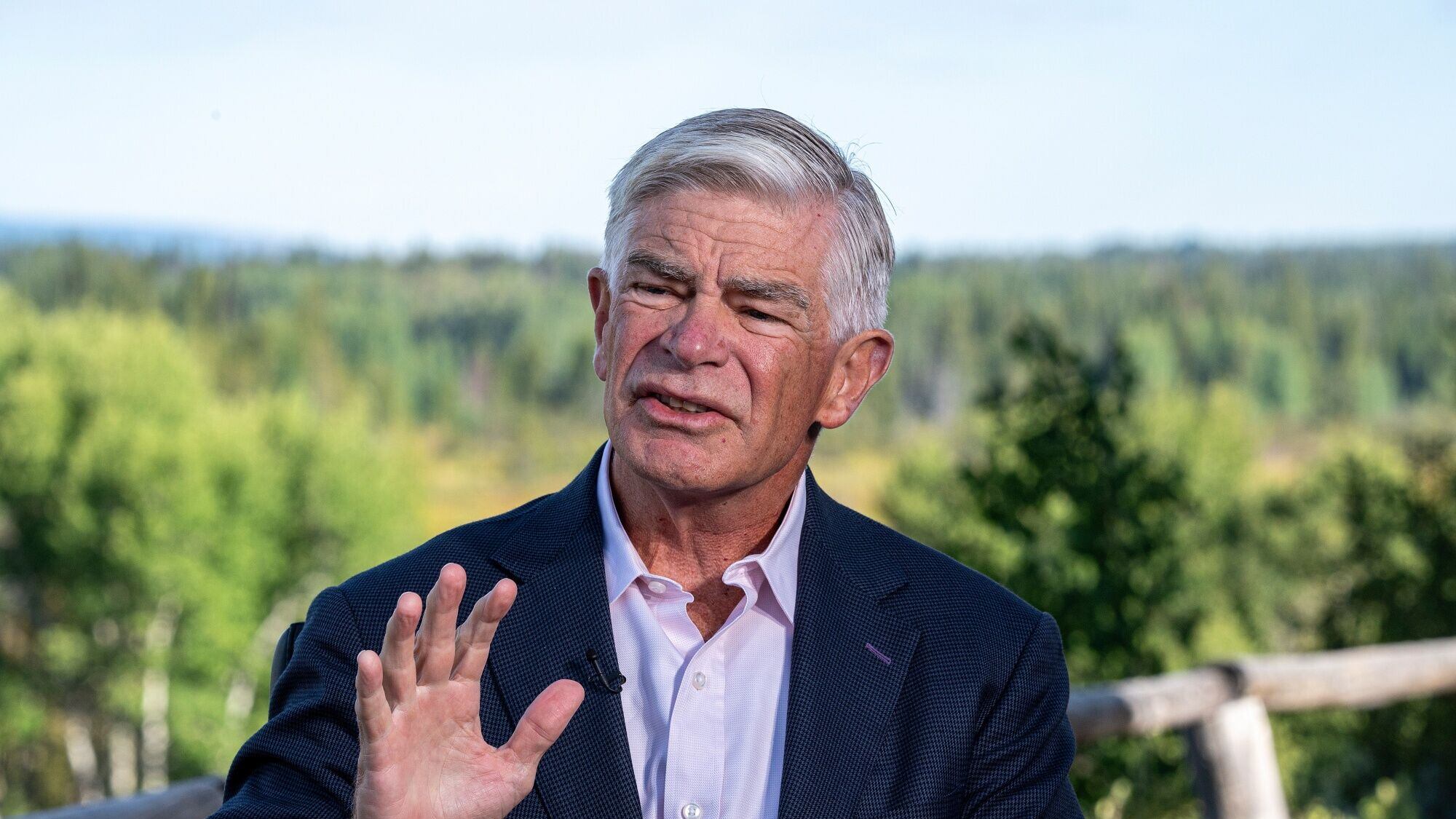

(Bloomberg) -- Federal Reserve Bank of Philadelphia President Patrick Harker said that it will likely be appropriate to cut interest rates this year, but emphasized the risks of easing policy too soon.

Lowering borrowing costs prematurely could unwind the progress made on inflation, Harker said, adding that he will be closely monitoring incoming data to verify the downward trend in price growth.

“I believe that we may be in the position to see the rate decrease this year,” Harker said Thursday in prepared remarks for an event in Newark, Delaware. “But I would caution anyone from looking for it right now and right away. We have time to get this right, as we must.”

Harker, who doesn’t vote on monetary policy this year, lauded inflation progress over the past few months but said he wants to see broader disinflation.

Read More: Fed Officials Eye ‘Broadening’ Disinflation as New Rate-Cut Test

A report earlier this month showed consumer prices rose in January by more than forecast, driven by shelter and services costs, while goods prices continued to decline. Officials will get an updated look at their preferred measure of inflation, the personal consumption expenditures price index, next week.

“As progress can be bumpy — and uneven at times — it is important that we see more evidence, allowing us to look past the vagaries of monthly data and ensure we continue on the right path,” Harker said. “Regardless, the data overall suggest that we are in the final mile of the marathon of getting PCE inflation back down to our target annual rate of 2%.”

Fed Vice Chair Philip Jefferson made similar remarks at a separate event Thursday, saying officials should be cautious about cutting rates too much as inflation improves, but that it would likely be appropriate to start the process of cutting later this year.

“So, in a nutshell, I find our greatest economic risk comes from acting to lower the rate too early, lest we reignite inflation and see the work of the past two years unwind before our eyes,” Harker said.

Harker added that he and his colleagues will discuss balance-sheet policy at their next meeting in March and that policymakers should slow the pace at which they’re shrinking the Fed’s asset portfolio as reserves, though still “very abundant,” decline.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.